Tax Brackets 2025 Married Jointly Irs

Tax Brackets 2025 Married Jointly Irs. Single, married filing jointly, married filing separately, or head of household. See the 2025 tax tables.

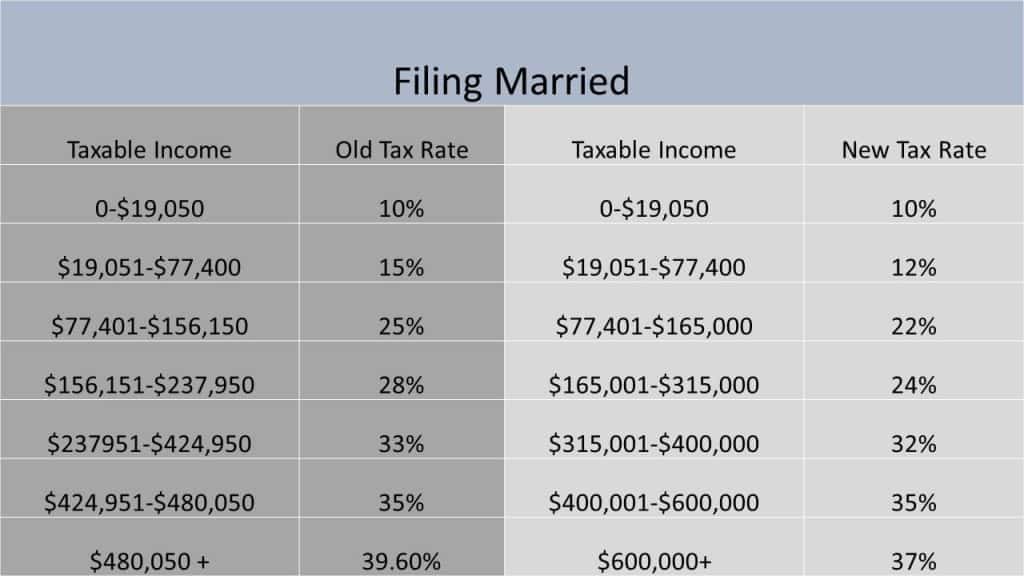

For example, if you’re married filing jointly for 2025 taxes with a taxable income of $95,000, you’d fall under the 22% tax bracket even though a majority of your taxable income ($94,300) falls under the 12% tax bracket. To figure out your tax bracket, first look at the rates for the filing status you plan to use:

2025 Irs Tax Brackets Married Filing Jointly Lara Saloma, 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Us Tax Brackets 2025 Married Filing Jointly Irs Jobey Lyndsie, Irs provides tax inflation adjustments for tax year 2025.

Irs Tax Brackets 2025 Married Jointly Else Gabriella, Remember, these aren't the amounts you file for your tax return, but rather the amount of tax you're going to pay starting january 1,.

2025 Tax Brackets Married Filing Jointly With Dependents Bonni Christi, This allows married couples to combine their income and deductions and file a single tax return.

Tax Brackets 2025 Calculator Married Jointly Lian Sheena, Your bracket depends on your taxable income and filing status.

Tax Brackets 2025 Married Jointly Table Jane Roanna, For married couples filing jointly, it will rise to $29,200 for 2025, up from $27,700 in 2025.

2025 Tax Brackets Mfj Married Jointly Cayla Daniele, Let’s say you’re married filing jointly with $110,000 in taxable income.

Standard Deduction 2025 Married Jointly 65 Years Geri Pennie, And make sure you paid all the tax due.